Charge a client for a purchase you have made on their behalf

Updated Feb 25th, 2026

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will assist you with the process for charging a client for all or part of a purchase invoice

Adding the Purchase Invoice

Post your supplier invoice on your supplier ledger. Note the nominal ledger that this has been allocated to. In the example below we have used a search provider nominal, and posted an invoice for searches for 2 separate client/matters. Input VAT is charged on this invoice:

Adding the charge to the client ledger as a disbursement

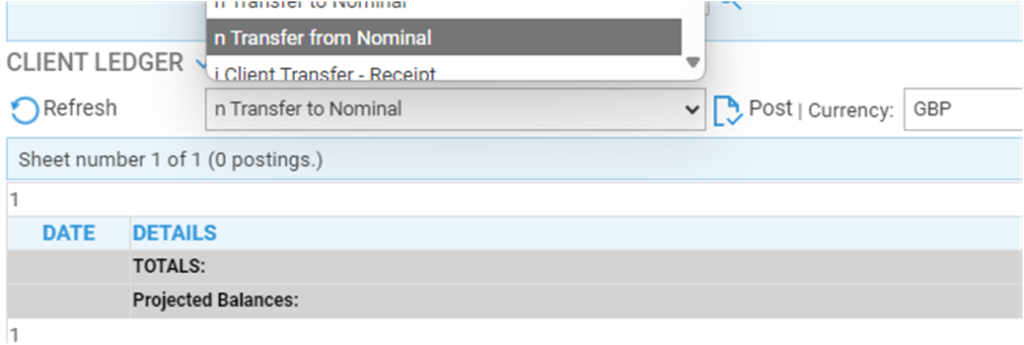

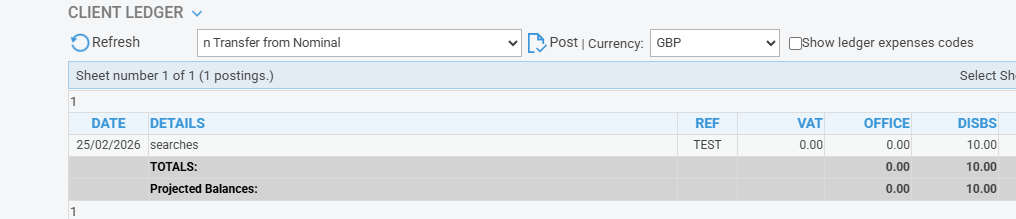

The £10 (net) purchase invoice in the step above is to be split between 2 client matters. In the client ledger, select posting type n – Transfer From Nominal:

Select the same nominal that your purchase invoice was posted to and post the net amount – Output VAT can be charged when your disbursement is added to the client’s bill.

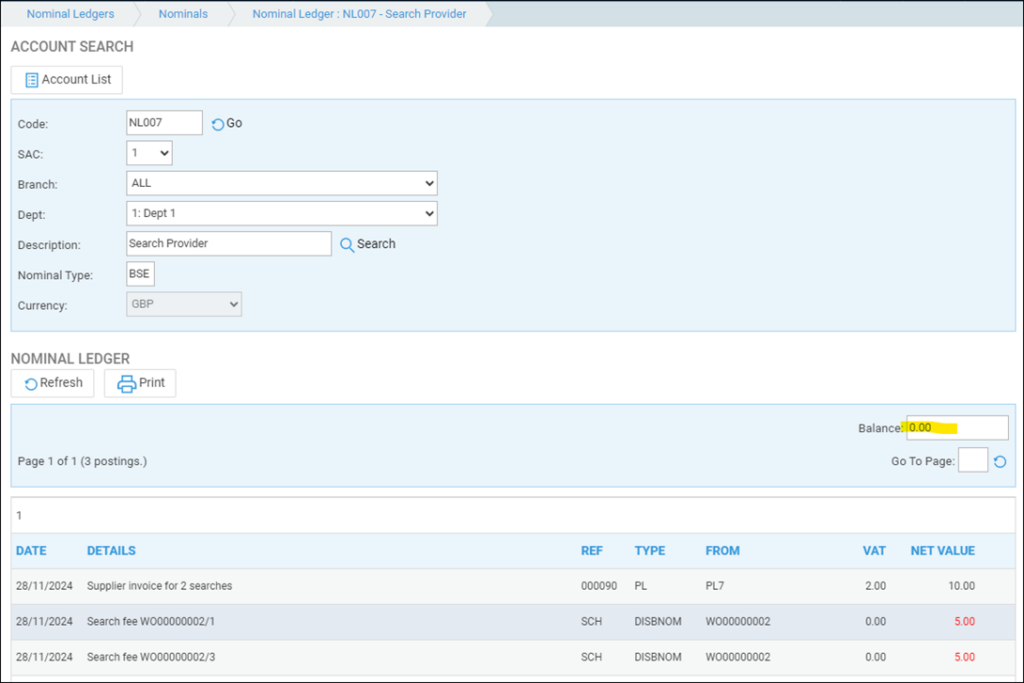

Effect on the nominal for searches

Once all of the individual search fees have been posted to the client ledgers, the nominal for search fees will be 0:

The Purchase Invoice can be paid as and when you make the payment from your bank. The VAT from this purchase will be accounted for at the point of invoicing.

Billing the Client

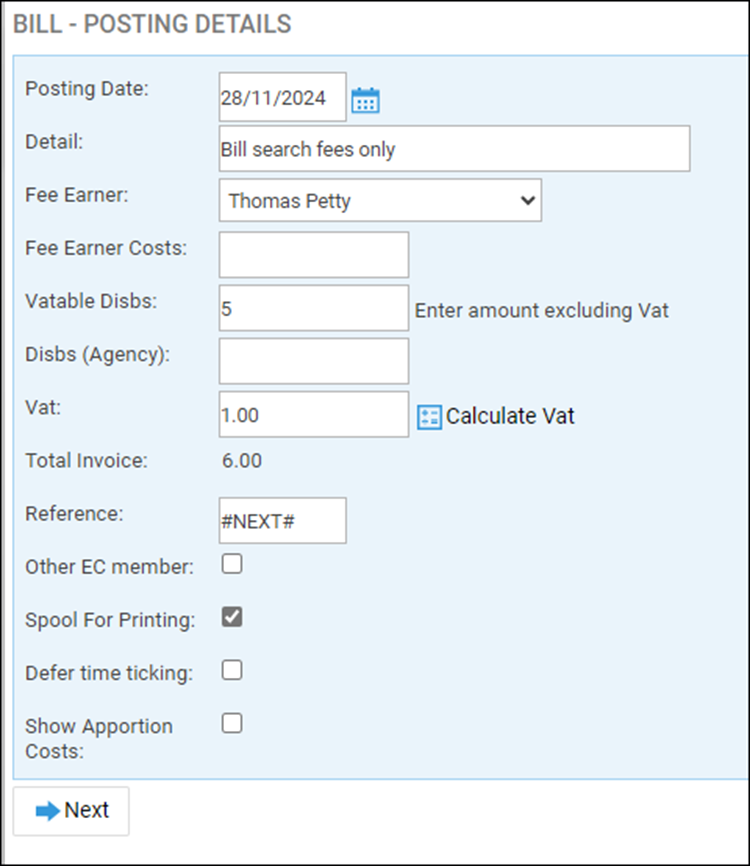

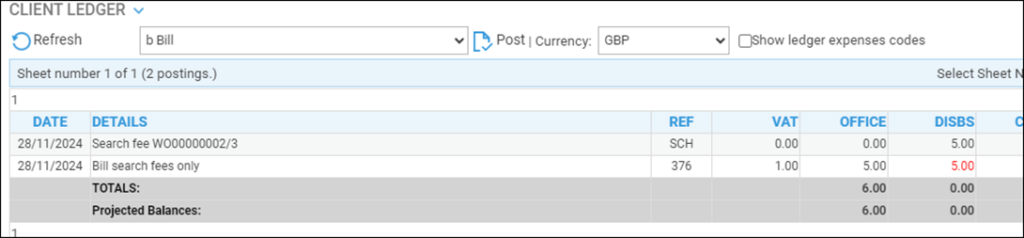

If VAT is to be charged to the client, when posting the bill, ensure you include the search fees in the Vatable Disbursements box.