Finding your VAT Liabilities Part Way through a Period

Updated May 8th, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will assist you if you want to know how much VAT you will be liable for but have not yet run the period end for the VAT quarter

Standard VAT

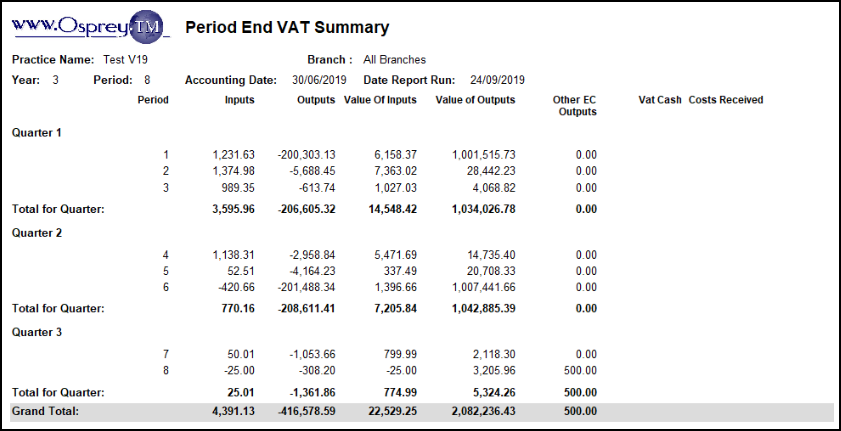

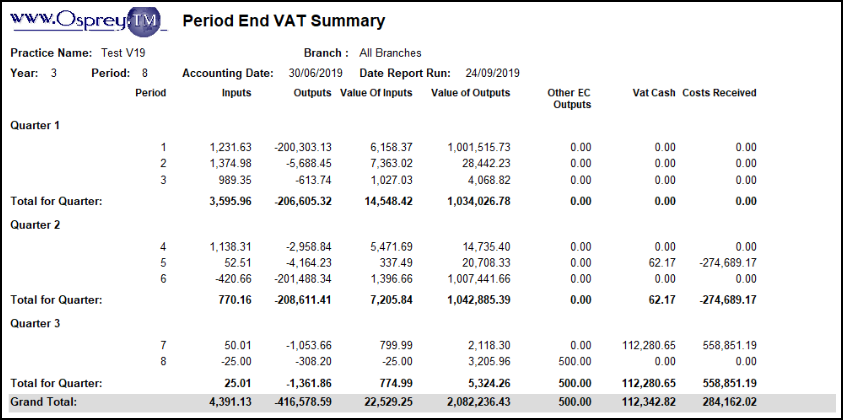

Firstly, print out the VAT Summary from the previous period end to extract any totals so far in the quarter.

E.g. if you are currently in period 2 of your quarter, extract the totals from the VAT summary for period 1. If you are in the last period of the quarter, extract the totals for the first two periods:

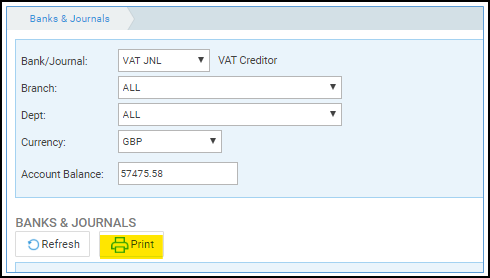

To get the current totals to date, navigate to Banks and Journals, select the VAT JNL from the list. Then select All Branches and Departments, and click Refresh. Print the VAT Journal using the Print button as below:

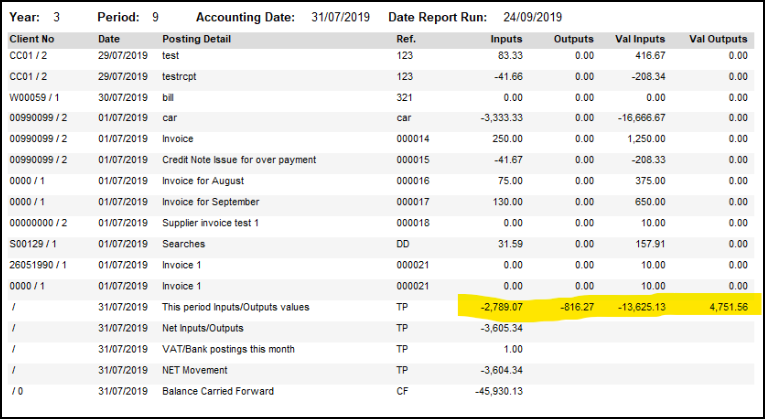

The report should look something like this:

Use the This period Inputs/Outputs values line as highlighted above as the current period figure.

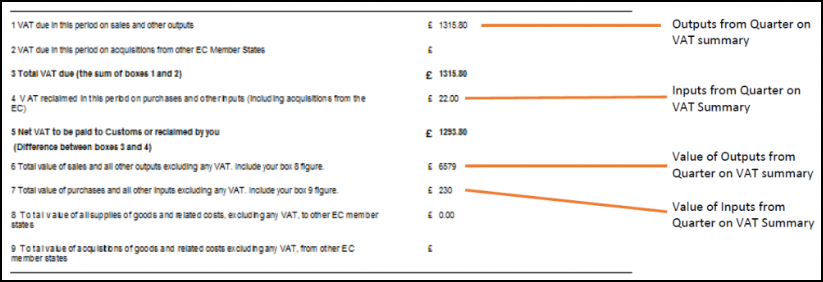

These can be added to the corresponding columns on the VAT summary report. They can then be transposed to the VAT Form as follows:

Cash Accounting

If the VAT registration type is Cash Accounting, firstly, print out the VAT Summary from the previous period end. This will allow you to extract any totals so far in the quarter.

E.g. if you are currently in period 2 of your quarter, extract the totals from the VAT summary for period 1. If you are in the last period of the quarter, extract the totals for the first two periods:

**** NB Use VAT Cash as Outputs figure and Costs Received as Value of Outputs figures ****

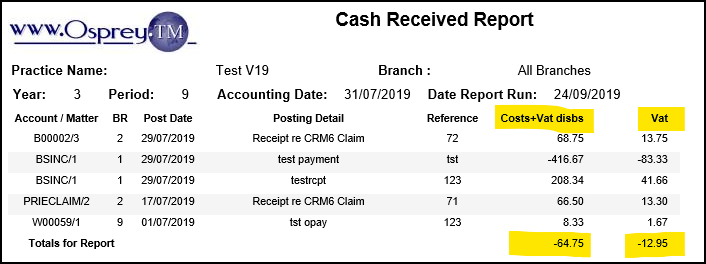

Now, run the Cash Accounting VAT Received report for the current period, from Reports > Financial Management:

The highlighted figures on the report should be added to the corresponding columns on the VAT Summary to make the final figures:

VAT column – add to VAT Cash on VAT Summary

Costs + VAT Disbs – add to Costs Received on VAT Summary