Posting Non Vatable Bills and the VAT Check Question

Updated Aug 5th, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide is intended to show you how to enter bills which are non-vatable or out of scope

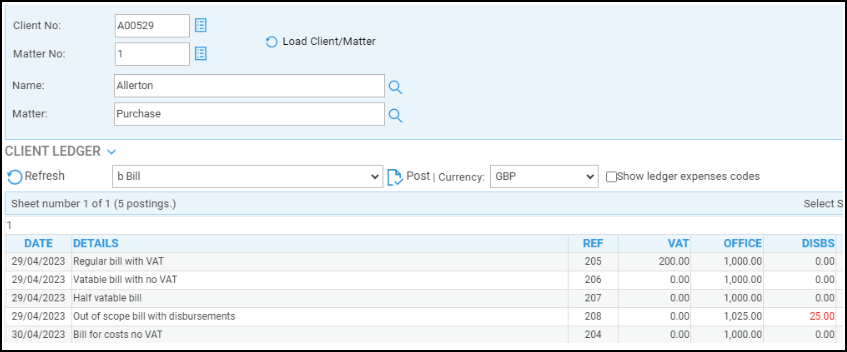

To post a bill, navigate to the Client Ledger and select the client / matter you wish to post the bill for.

Choose the posting type b Bill and click Post.

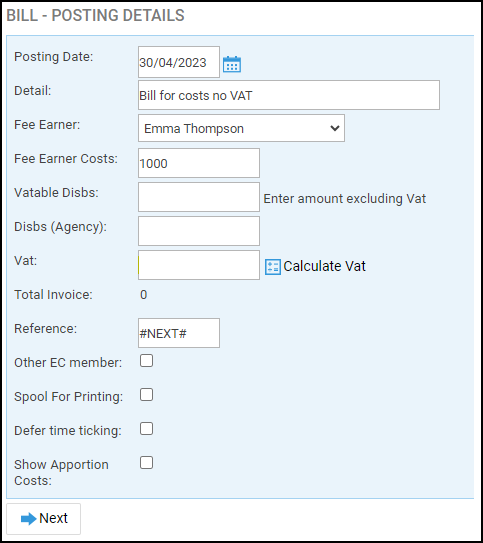

Fill in the details of the bill, leaving the VAT box blank.

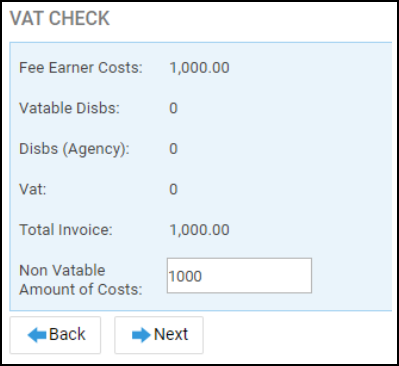

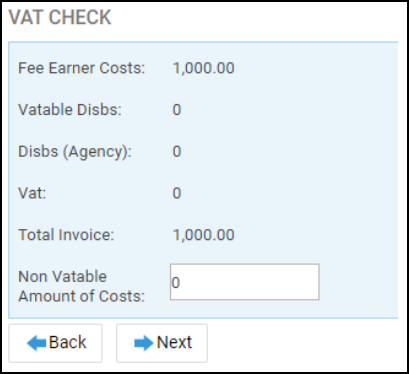

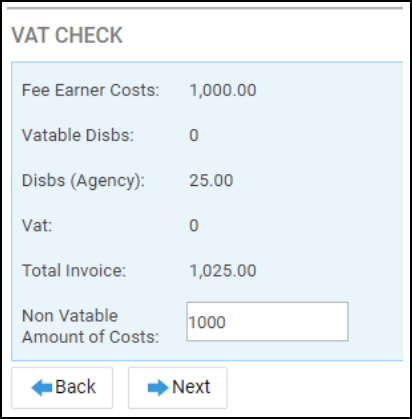

Click Next. The VAT Check screen will appear, prompting you to enter the Non-Vatable amount of Costs:

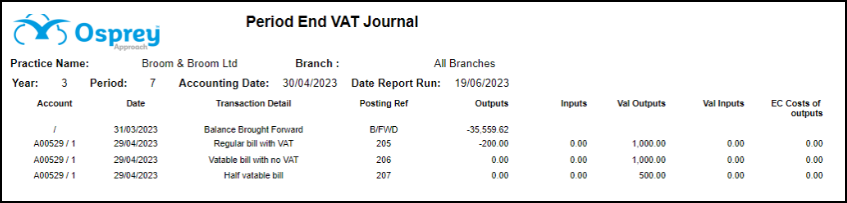

This bill has been marked as completely non vatable, as the full amount of Costs has been entered into the Non Vatable Amount of Costs box. It will not appear in the VAT Return. Use this for Out of Scope bills.

This bill has been marked as completely vatable (£0 of the costs are non vatable), but with no VAT. This bill will appear in your VAT return with the Costs amount in the value of outputs, and 0 in the outputs.

If your bill contains disbursements, ignore these from the calculation. The system is asking for the non vatable amount of costs only. This bill is out of scope, with disbursements, so we have added the costs amount to the Non Vatable Amount of Costs box. This bill will not appear on your VAT Return.

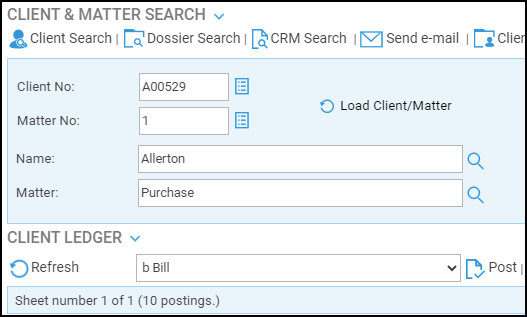

We can now see that although there are 5 bills on our example ledger, only 3 of them appear on the VAT Return, because for bills 204 and 208, we opted to select 100% of the costs as non vatable: