Set up Standard Letter Charging

Updated Jul 31st, 2024

Who is this guide for?

Case Management Supervisors and System Supervisors

You can set standard rates for certain standard letters or alternatively set a rate for the whole site. This guide will go through the process

It is possible within Osprey to set some letters to time record, others not and those which do charge to charge at different rates. Legal aid matter letters always time record at the rate allowed by the LAA according to the remuneration type of the matter. You can have standard letters time recording on either an Hourly or Fixed rate basis.

Standard Letter Charging – System

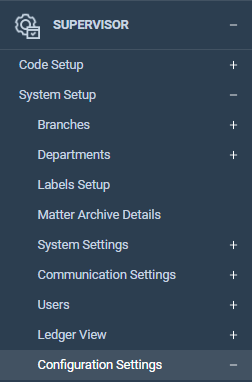

Navigate to your ‘Supervisor’ tab on the side menu. Now select ‘System Setup’ and then click on ‘Configuration Settings’ to bring up a list of system switches.

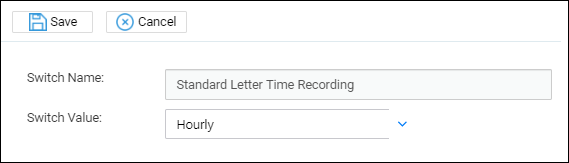

Search for ‘Standard Letter Time Recording’, right-click on the configuration setting and then select ‘Edit’.

You can select ‘Hourly’, ‘Fixed’ or ‘None’ from this drop-down list.

Once you have selected the value, click on the ‘Save’ icon to keep your changes and return to the ‘Configuration Settings’ list.

You are able to set a default fixed letter rate. Navigate to the ‘Supervisor’ area and select ‘System Setup’. Now click on ‘System Settings’.

There will be an option for ‘Standard Letter Price’. Click the ‘Edit’ icon in the top left and amend this figure if you wish. Then select ‘Save’.

Standard Letter Charging – Individual Letters

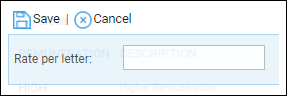

In addition to the above, you can set a fixed rate specific to a particular template. If this is set, then this will override the default fixed rate whether it is global, work type specific or on a private matter.

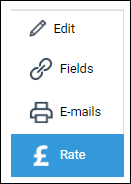

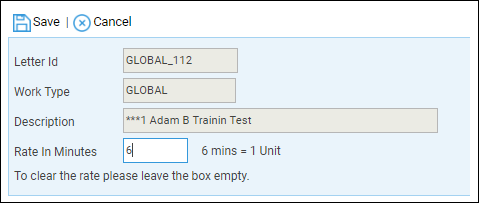

In your ‘Supervisor’ area, select ‘Case Management Setup’ and then click on ‘Standard Documents’. Now right click on the letter you want to add a rate for and press ‘Rate’

Click the ‘Save’ button. You can link as many remuneration types to a template as you wish.

With the ‘Hourly Rate’ option, standard letters will time record at the fee earner’s hourly rate for the remuneration type set against the matter.

If the Fee Earner is linked to the remuneration type, then this rate will be used. If the Fee Earner is not linked to the remuneration for this matter the default rate for the remuneration type will be used.

The time costing is calculated as follows:

Fee Earner rate x Base Rate % x Rate in Minutes / 60 = charge rate

e.g. a) £300 x 100% x 6/60 = £30.00

e.g. b) £300 x 50% x 6/60 = £15.00

The ‘Rate in Minutes’ has to be set for each template.

Go to your ‘Supervisor’ area, select ‘Case Management Setup’ and then click on ‘Standard Documents’.

Click on the ‘Rate’ button against the required template as described above, enter the rate and submit.

Please note that if the rate is set to 6, the letter will time record as 6 mins. If the rate is set to 0, the letter will time record as 0 mins, e.g. £0.00. If the rate is left blank, the letter will time record at the Default Fixed Letter Rate set in System Settings

The Base Rate can be set on any Work Type specific template. It will then apply to all templates for that Work Type and Global templates when they are merged on a matter of this Work Type.

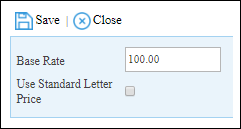

To set the Base Rate, go to your ‘Supervisor’ area, select ‘Case Management Setup’ and then click on ‘Standard Documents’. Now click on the ‘Rate’ button against the required template Work Type specific template.

Click on the ‘Set Base Rate’ button.

Enter the Base Rate. this is the percentage of the Fee Earner’s Rate you wish to be used, so set to 100.00 if you wish to time record at the Fee Earner’s rate. Enter 50.00 for half the rate, etc.

Click ‘Save’ to save the change and then click ‘Close’ to close the window.

If you want to have templates for the same work type to record different costs you have to use the Rate in Minutes option.

£300 x 100% x 6/60 = £30.00

£300 x 100% x 12/60 = £60.00