Troubleshoot Making Tax Digital Error Messages and Other Problems

Updated Dec 4th, 2025

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will take you through the most common problems experienced with the MTD functionality

If you are trying to submit your VAT return via MTD but are receiving an error message refer to the following.

Government Gateway Window does not pop up when clicking New VAT Submission

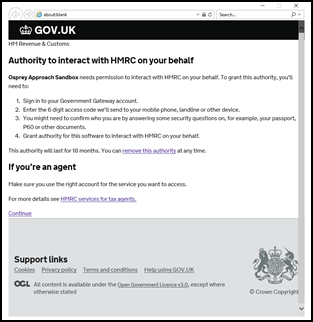

If it is your first MTD submission using Osprey, or you have recently cleared your HMRC access token, and the Government Gateway window does not pop up, please check that your browser allows pop ups, and that if you are using any browser add-ins, such as the Google Toolbar, these are also not blocking pop ups. If the window still does not pop up, your URL may not have been added to our Site Router database, so please contact support.

“Unexpected Error” when clicking List Obligations/List Liabilities/List Payments

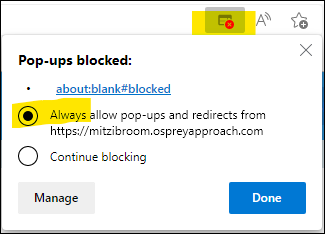

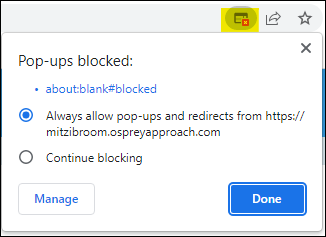

This occurs when your HMRC token has been deleted or does not exist, and pop ups are blocked on your browser. Return to Reports > Financial Management > VAT MTD (Make Tax Digital). Click New VAT Submission and look for the blocked pop ups notification – in Edge and Chrome these will appear at the end of the address bar at the top of your browser. Click this and select Always allow popups and redirects from Osprey.

In Edge:

In Chrome:

MTD Figures do not match the Osprey VAT Form

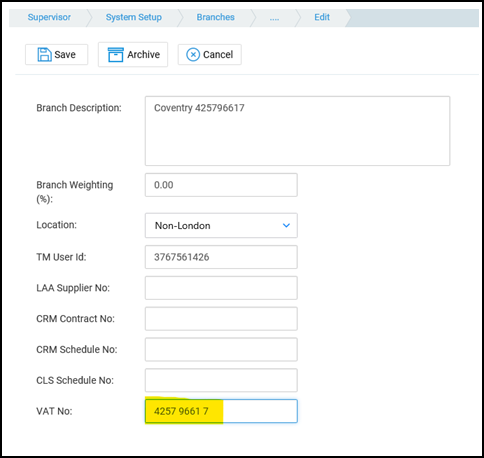

If the MTD submission figures do not match your Osprey VAT Form figures, you may not have filled in your branch VAT Registration Number correctly. MTD figures will look at all vatable postings according to the branch VRN, whilst the Osprey VAT Form will display based on the branch you have selected when running the reports. To check this, Set your VAT number >

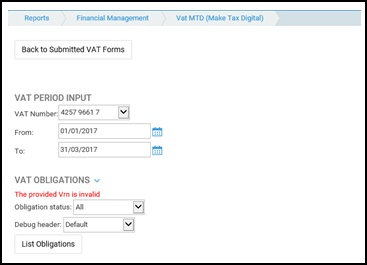

The provided VRN is invalid

HMRC does not recognise your VAT Registration Number. In the screen shot above we can see that the VAT Number has spaces in it. Please check that you have entered the correct VAT Registration Number, with no spaces or other characters, for your branch as follows:

- Supervisor > System Setup > Branches.

- Right click each of your branches in turn and select Edit.

- Amend the VAT number shown below, ensuring it has no leading or trailing spaces, nor any spaces within the number itself, and that it is the correct VRN for your firm.

The client and/or agent is not authorised

Possible causes:

- You have not registered with HMRC for MTD. Osprey can only be used to submit your VAT returns electronically if you have registered with HMRC.

- You have logged in to the wrong Government Gateway account.

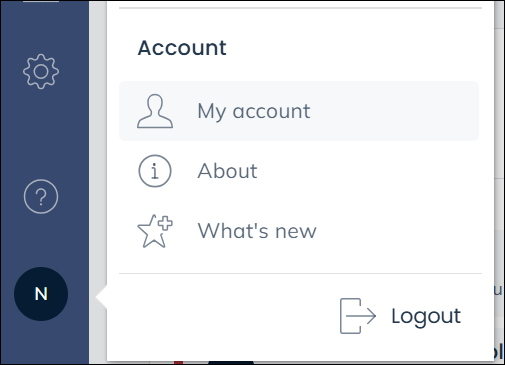

- Your Osprey stored HMRC access token is not correct. This contains your user name/password combination to login to your firm’s Government Gateway Account. Please delete your HMRC access token from User Profile and try again:

a. In the bottom left-hand corner of Osprey, click your initial, then My account:

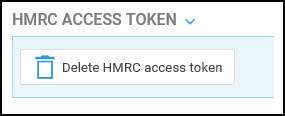

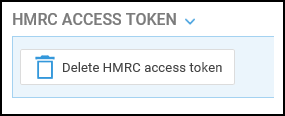

b. Scroll down to the HMRC Access Token area, and click Delete HMRC Access Token:

Once you have completed the steps above, try the submission again, ensuring that you have entered the credentials supplied to you by HMRC.

Cannot use this service because it is set up for VAT using a different User ID

This is likely to be that your Government Gateway account is set up to be managed by an agent, e.g. a previous firm of book keepers. You will need to contact HMRC to correct this.

Invalid Authentication information provided

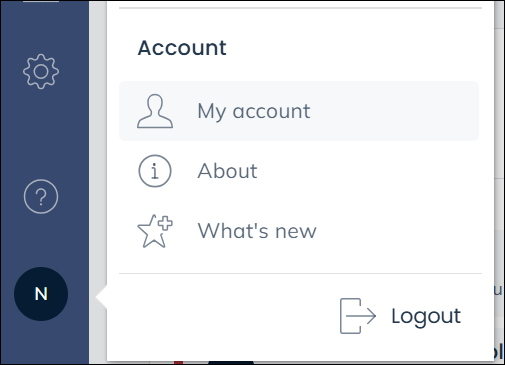

Your Osprey stored HMRC access token is not correct. This contains your user name/password combination to login to your firm’s Government Gateway Account. Please delete your HMRC access token from User Profile and try again:

a. In the bottom left-hand corner of Osprey, click your initial, then My account:

b. Scroll down to the HMRC Access Token area, and click Delete HMRC Access Token:

Once you have completed the steps above, try the submission again, ensuring that you have entered the credentials supplied to you by HMRC.

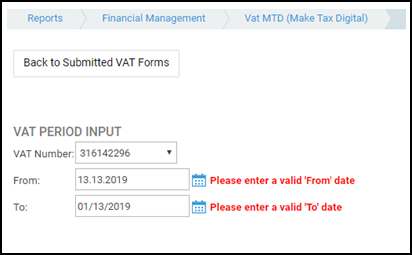

Please enter a valid ‘From’ date / Please enter a valid ‘To’ date

The From and/or To date entered for the start and end of your VAT quarter have been entered incorrectly. Please use English date format dd/MM/yyyy using / to separate the dates, not full stop. Example of incorrect entries below.

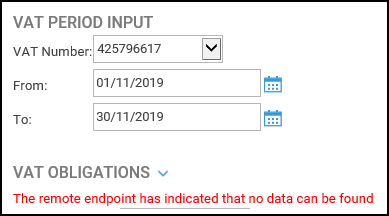

The remote endpoint has indicated that no data can be found

When clicking List Obligations

Possible causes are either:

- The HMRC Making Tax Digital portal is down – you can check your Government Gateway account to see messages relating to maintenance of the MTD system.

- You have entered incorrect period start and end dates.

- You are submitting before HMRC expect you to. Please try again later.

Please note that VAT submission date and period expectations are set by HMRC through your Gateway account. If you are planning to submit VAT at the end of a period which differs to your usual submission date, HMRC will need to be made aware of this, and have set this up against your company Gateway account. Osprey VAT Quarter ticks will have no bearing on the periods/dates that the HMRC API looks for.

When Clicking List Liabilities

Ensure that you have selected a period for which you have already submitted a VAT return.

When Clicking List Payments

Ensure that you have selected a period for which you have paid your VAT.

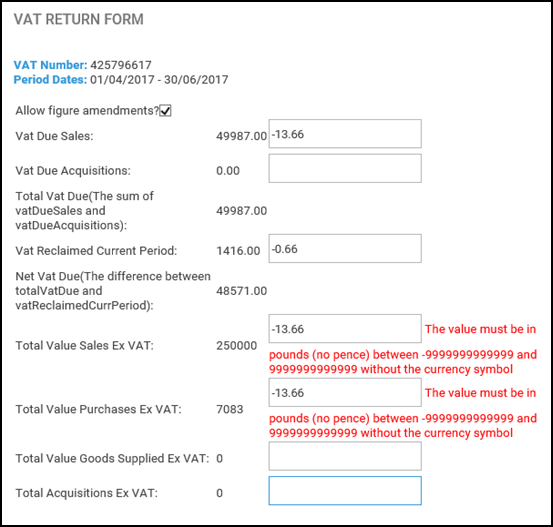

The value must be in pounds (no pence)

When amending figures on the VAT return form, once you have entered the amendment figure (e.g. to decrease a figure by £100.10, you have entered £-100.10), the following message appears:

As per the requirements set out by HMRC, certain boxes on the VAT form are populated with whole figures only, so no pence should be included. You should enter the amount of the amendment, preceded by a minus sign if you are reducing a figure, to the nearest whole number.

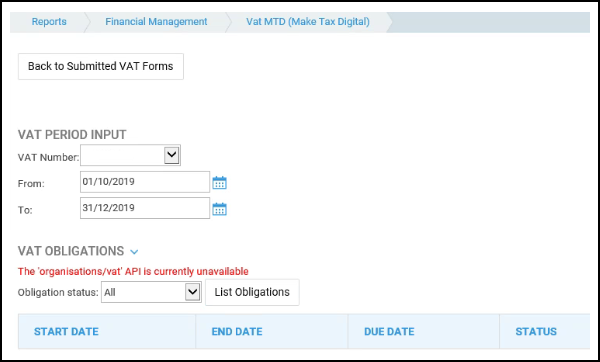

The ‘organisations/vat’ API is currently unavailable

When selecting the VAT number, From and To Dates and then clicking List Obligations you receive this message:

This means that the HMRC portal is currently unavailable. Please try again later, or contact HMRC for further assistance.