Purchase Ledgers with VAT Cash Accounting

Updated Dec 3rd, 2025

Who is this guide for?

Accounts Users and Accounts Supervisors

Purchase Ledgers with VAT Cash Accounting

Purchase Ledgers in Osprey do not support cash accounting

VAT Considerations

If you are currently set up to use the Cash Accounting method of VAT but want to use Purchase Ledgers. In Osprey, the purchase ledgers are not designed to work with the cash accounting style of VAT. Firms who use the cash accounting VAT style do not become liable for VAT on purchases until the invoice is paid.

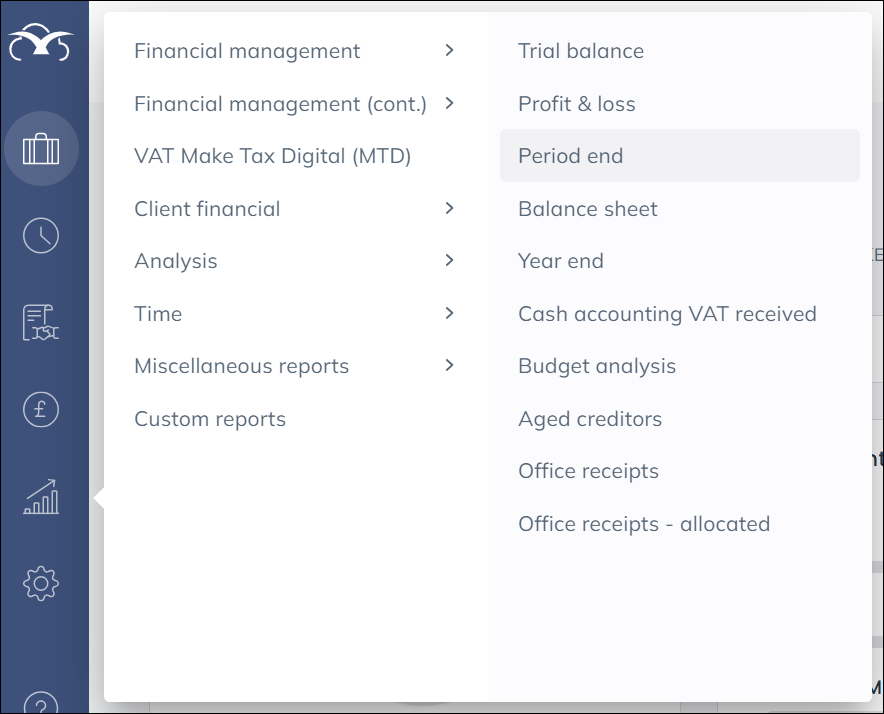

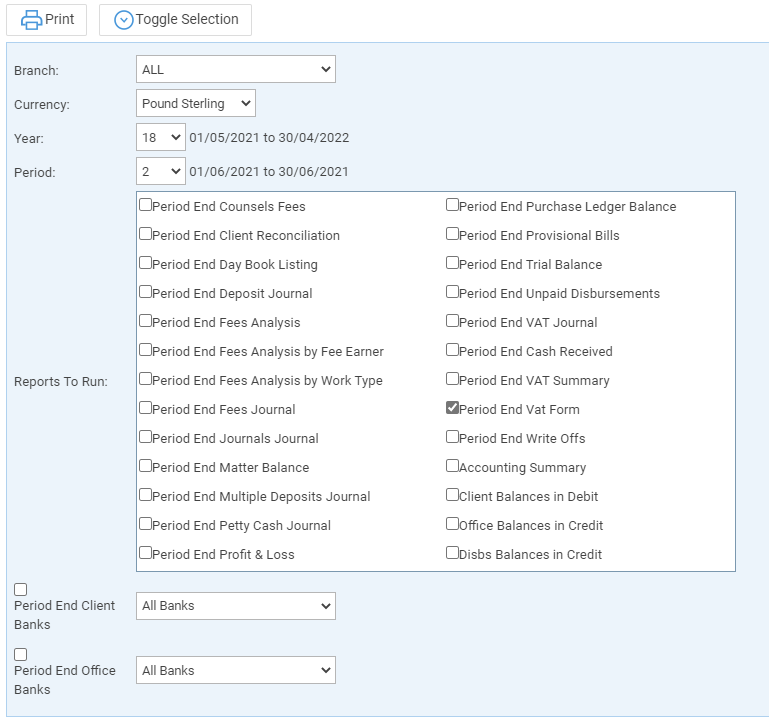

If you always pay your supplier invoices in the same period as they are raised, the standard VAT Form

produced in Period End reports should be accurate