Use Purchase Ledgers with VAT Cash Accounting

Updated Jul 10th, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will take you through how to use purchase ledgers when set up to use cash accounting

VAT Considerations

If you are currently set up to use the Cash Accounting method of VAT but want to use Purchase Ledgers. In Osprey, the purchase ledgers are not designed to work with the cash accounting style of VAT. Firms who use the cash accounting VAT style do not become liable for VAT on purchases until the invoice is paid.

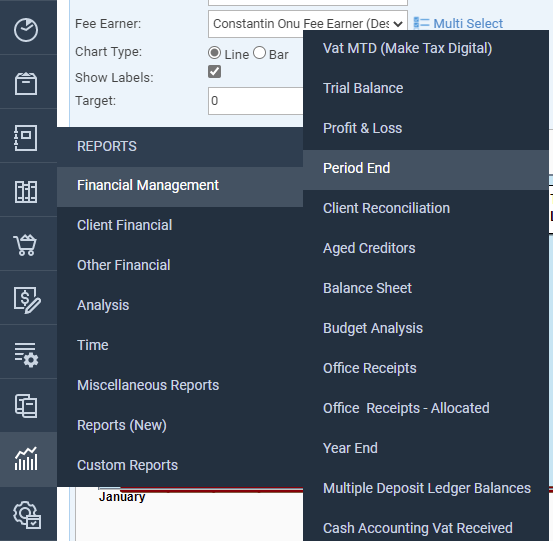

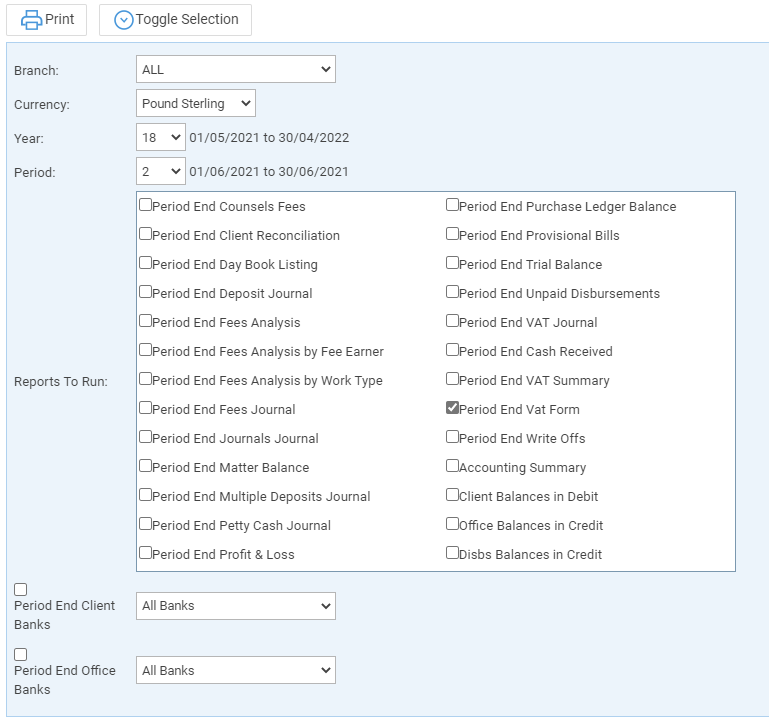

If you always pay your supplier invoices in the same period as they are raised, the standard VAT Form produced in Period End reports should be accurate

If the invoices are paid in later periods, this could affect your VAT return. There is a report which you can use to manually adjust your VAT return however.

Please ensure that payment terms are correctly set within your purchase ledger suppliers. The system will assume that invoices from a supplier who gives 30 days credit are not due until 30 days after they are posted, so will not necessarily appear in the same period as they were posted.

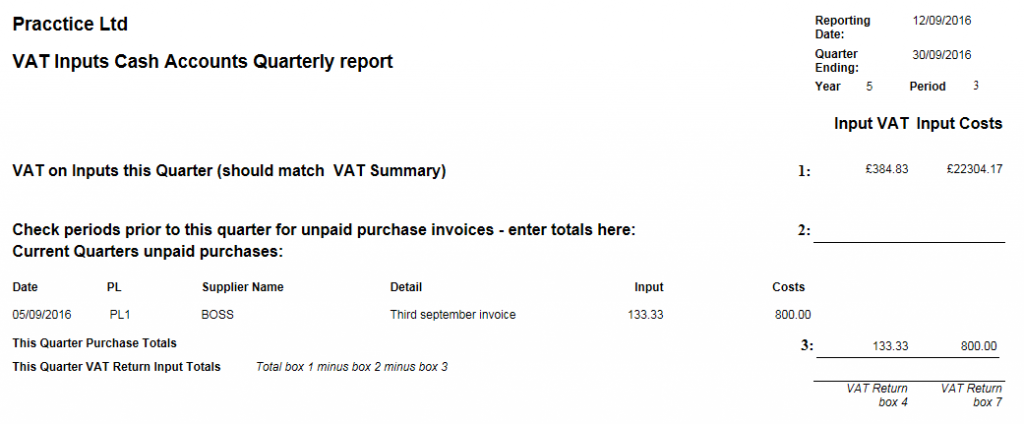

VAT Cash Accounting Purchase Inputs Report

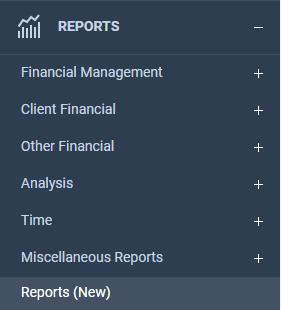

Navigate to the ‘Reports’ tab and select the option for Reports (New).

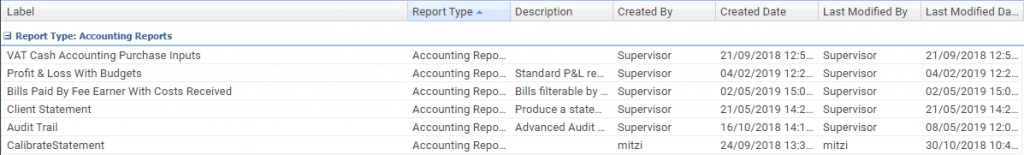

Under the Report Type ‘Accounting Reports’ there should be a report called VAT Cash Accounting Purchase Inputs.

Double click it to open the report.

Using the available filters on the left-had side, run and print the report between the start and end dates of your VAT Quarter.

Fill in box 2 manually. This should be the totals of any purchase invoices still unpaid prior to the beginning of the VAT quarter you are completing now. You can run the same report again using a date range of:

From Date: Oldest unpaid purchase ledger invoice

To Date: End of last VAT Quarter and taking the box 3 totals.

Work out the ‘This Quarter VAT Return Input’ totals using the formula shown on the report:

Box 1 – Box 2 – Box 3 = VAT Return figures