AML Risk Assessment

Updated Sep 27th, 2024

This workflow helps you to meet your obligations under The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. The workflow will prompt the user to analyse both the client and matter risk. The tasks can be integrated into your existing workflows where needed, or run as a standalone workflow on existing work types.

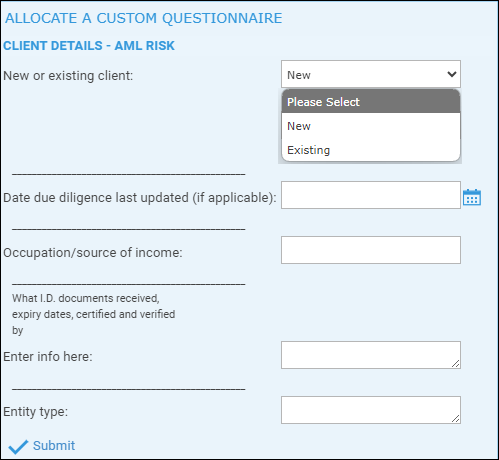

Task 1 AML Initial Risk AssessmentAllocate a Custom Questionnaire

CLIENT DETAILS – AML Risk

Allocate a Custom Questionnaire

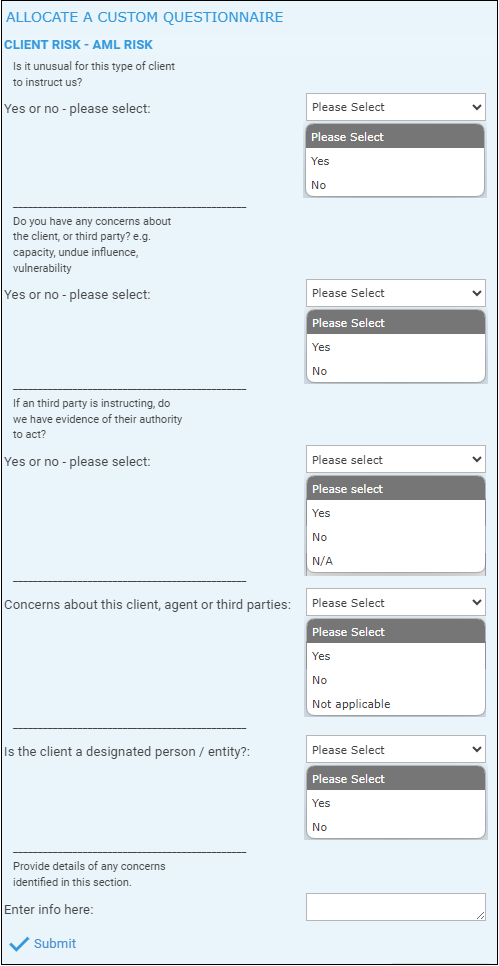

CLIENT RISK – AML Risk

Allocate a Custom Questionnaire

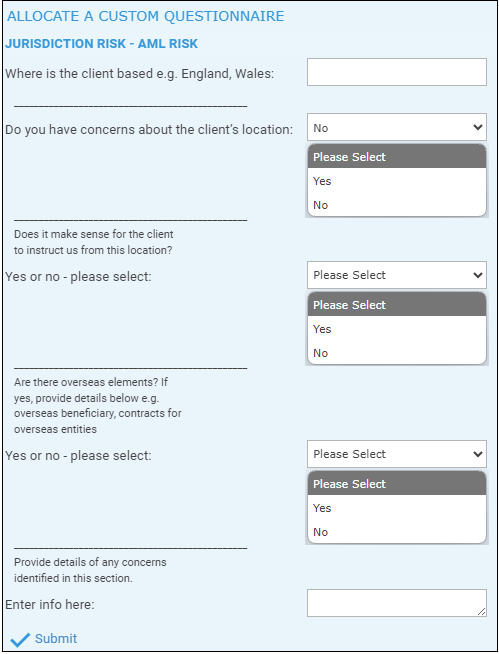

JURISDICTION RISK – AML Risk

Allocate a Custom Questionnaire

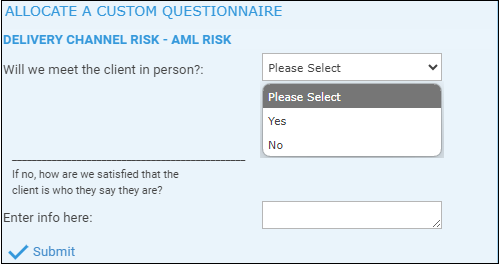

DELIVERY CHANNEL RISK – AML Risk

Allocate a Custom Questionnaire

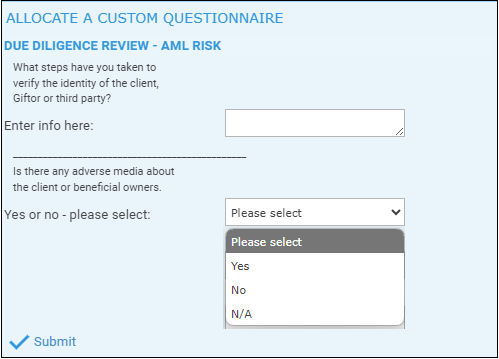

DUE DILIGENCE REVIEW – AML Risk

Allocate a Custom Questionnaire

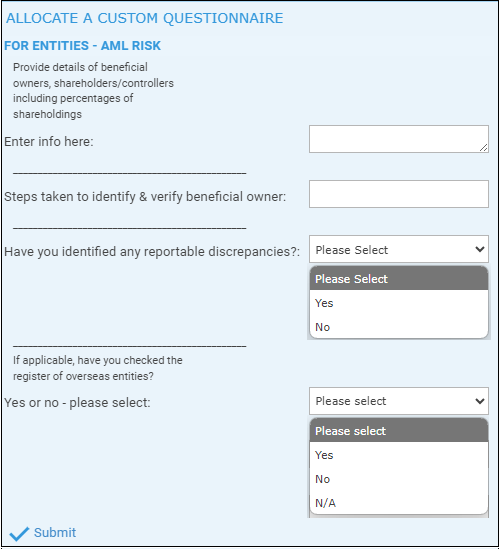

FOR ENTITIES – AML Risk

This will only run if the Entity Type field is filled in

Allocate a Custom Questionnaire

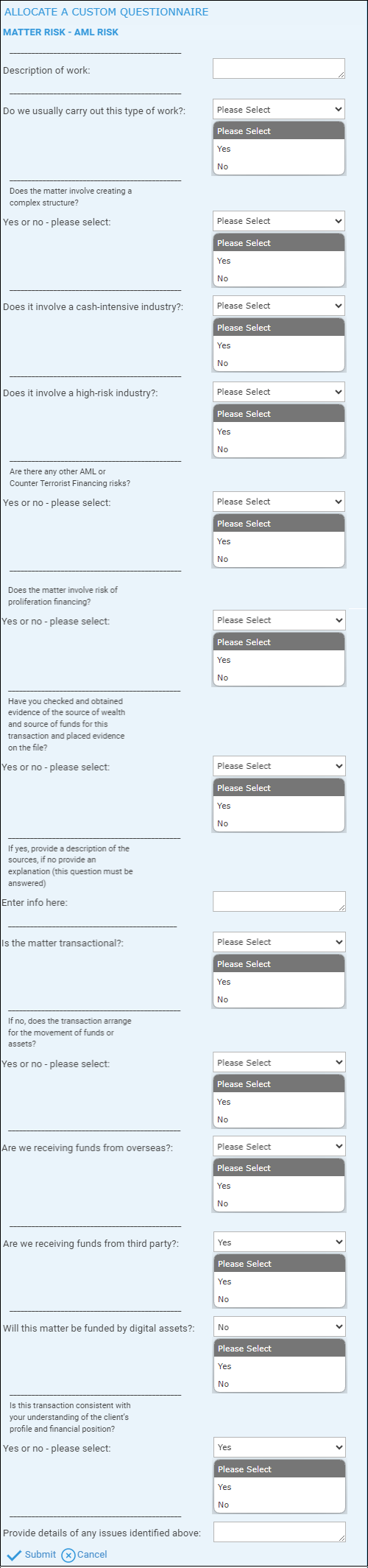

MATTER RISK – AML Risk

Allocate a Custom Questionnaire

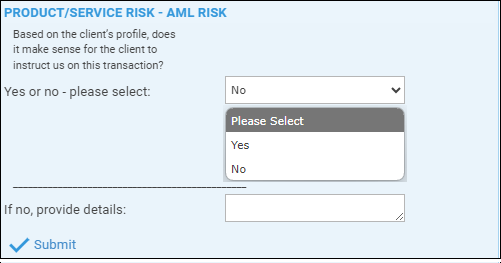

PRODUCT/SERVICE RISK – AML Risk

Allocate a Custom Questionnaire

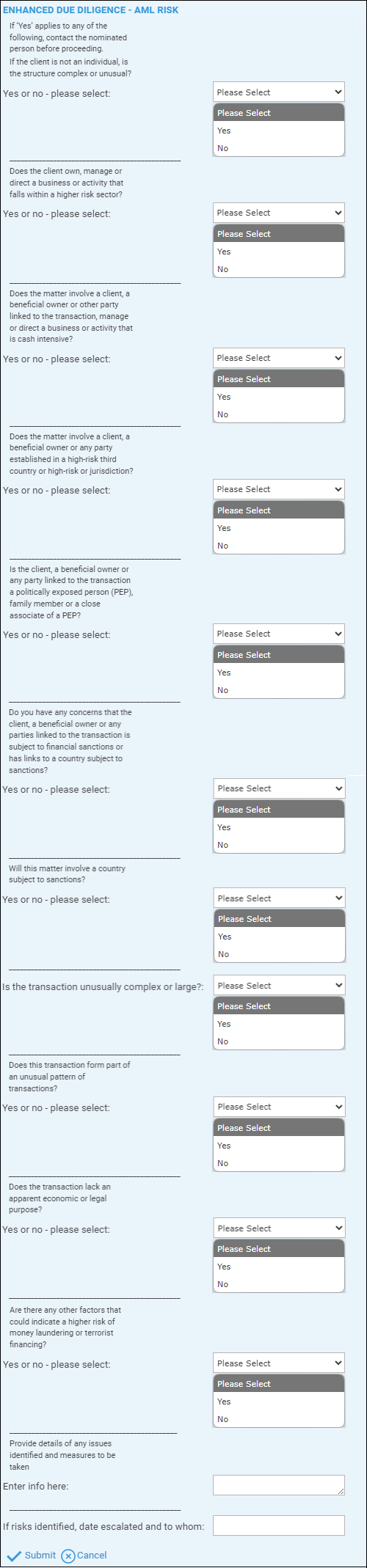

ENHANCED DUE DILIGENCE – AML Risk

Allocate a Custom Questionnaire

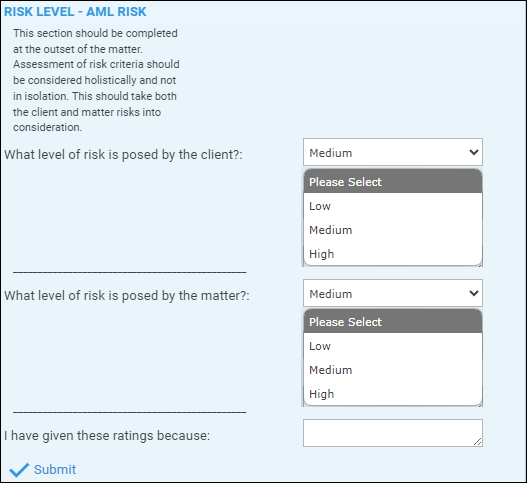

RISK LEVEL – AML Risk

Allocate a Custom Questionnaire

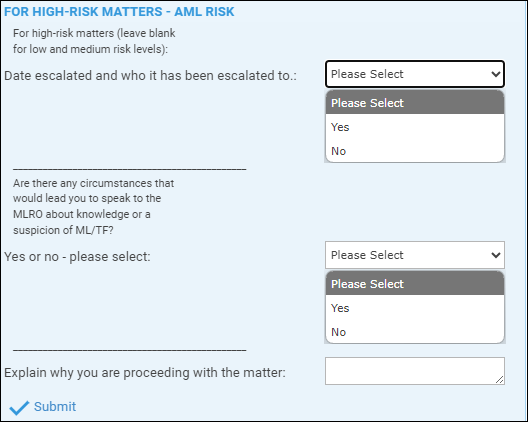

FOR HIGH-RISK MATTERS – AML Risk

This will only run if either What level of risk is posed by the client? or What level of risk is posed by the matter? is set to High,

Allocate a Custom Questionnaire

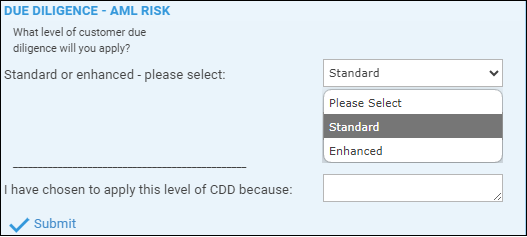

DUE DILIGENCE – AML Risk

Send Standard Document

Allocate a Custom Questionnaire

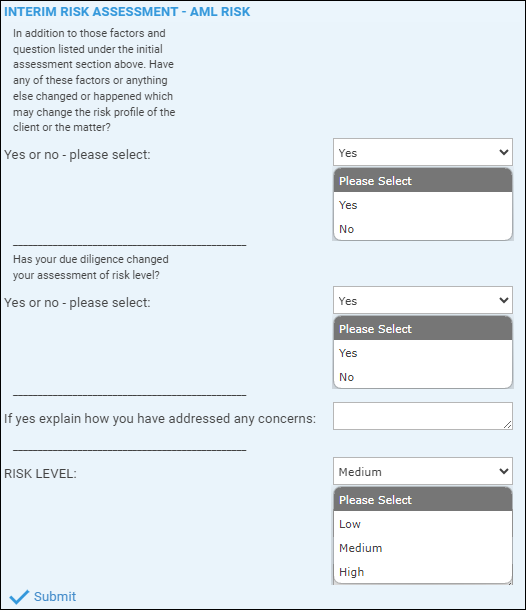

INTERIM RISK ASSESSMENT – AML Risk

Send Standard Document

Allocate a Custom Questionnaire

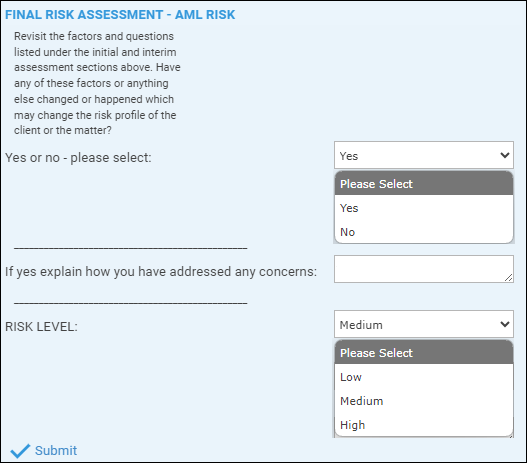

FINAL RISK ASSESSMENT – AML Risk

Send Standard Document