Reports: Cash Accounting VAT Received

Updated Dec 30th, 2025

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will take you through the Cash Accounting VAT Received report

Produces a list of transactions for firms using the VAT Cash Accounting method to use for their VAT figures. These figures will replace the Outputs/Value of Outputs figures on the VAT journal and summary reports.

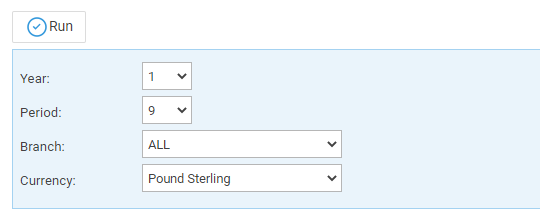

Filter Options

- Year – select the year you wish to report on from the drop down list

- Period – select the period you wish to report on from the drop down list

- Branch – defaults to All. Select individual branches from the drop down list

- Currency – shows the default currency. Other in use currencies can be selected from the drop down list

List of Columns produced

- Client and Matter number

- Branch

- Posting Date

- Posting Detail

- Posting Reference

- Costs+VATable Disbursements

- VAT