Paying VAT to HMRC

Updated Nov 19th, 2025

Who is this guide for?

Accounts Users and Accounts Supervisors

This guide will take you through the methods of paying VAT to HMRC

Osprey will allow you to keep track of the quarterly collection of VAT to HMRC using the VAT Journal.

At the end of quarter the amount of VAT due to HMRC is payable.

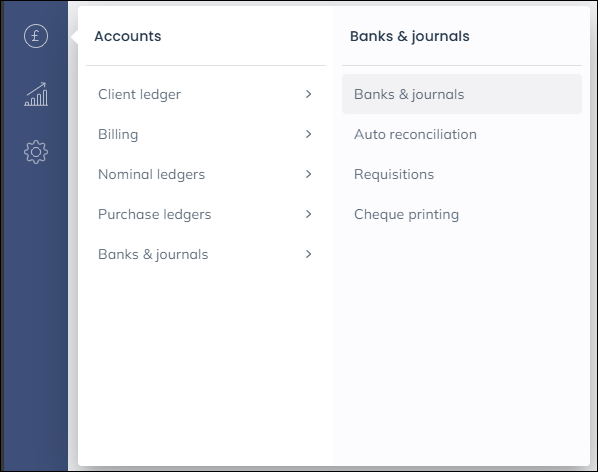

Select Accounts > Banks & Journals > Banks & Journals

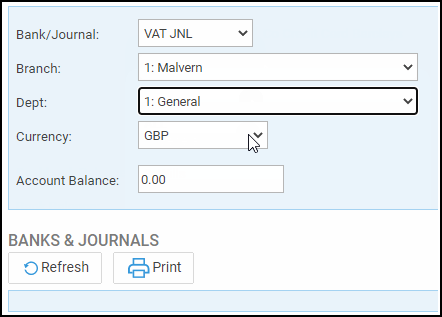

Choose VAT JNL, select the relevant Branch and Dept and click Refresh

Click Post

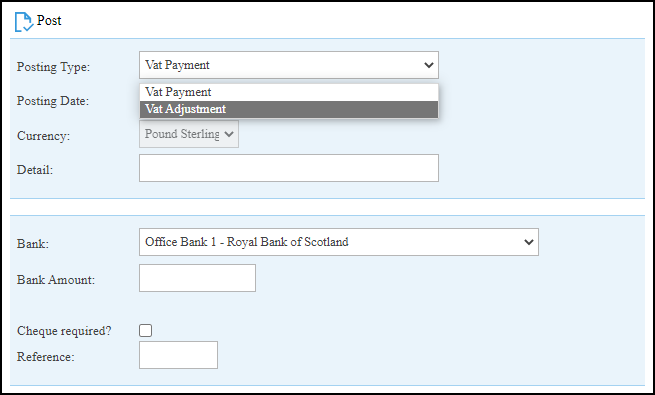

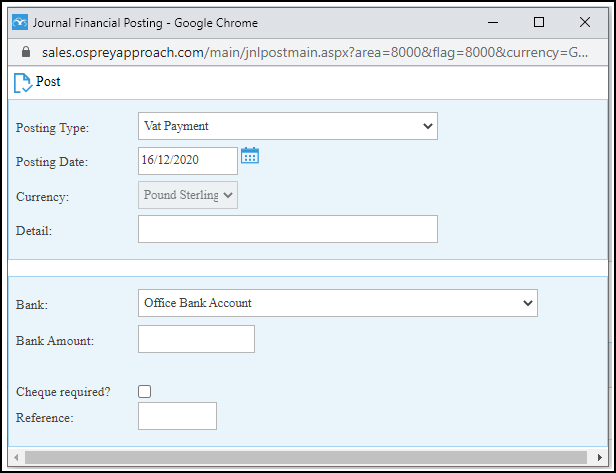

The posting type will show as Vat Payment

Set the correct Posting Date, type the appropriate Detail, from the drop-down list select the correct bank, the Bank Amount is the amount to be paid to HMRC.

Enter a reference and click Post.

If a refund has been received, this can be posted as a VAT Adjustment.