Understand VAT Reports

Updated May 10th, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

You can produce VAT reports on Osprey. This guide will help you to understand them.

Standard VAT

The Standard VAT method is where you become liable for the VAT as soon as

- you bill a client

- your supplier bills you

There are a number of reports in Osprey which detail the VAT on the system.

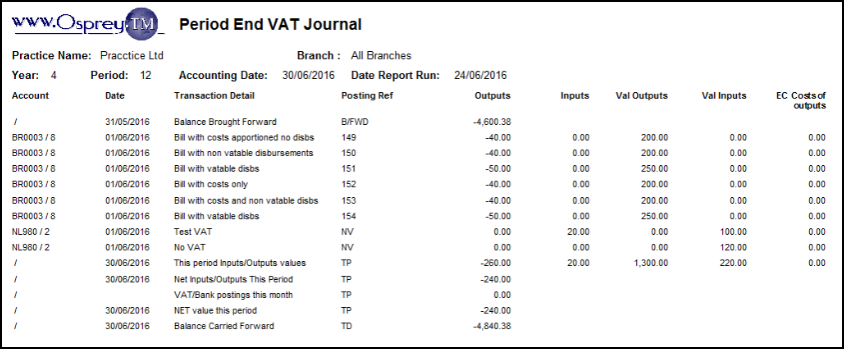

Period End VAT Journal (Reports > Financial Management > Period End)

This lists all vatable transactions on the Osprey system for the period, including a balance brought forward from previous periods. This includes any nominals which are not ticked to Exclude from VAT – it is important therefore to ensure that any non-vatable nominals are ticked to Exclude VAT.

| Description | How is it calculated? |

|---|---|

| This period Inputs/Outputs values | The sum of all postings in the period |

| Net Inputs/Outputs This Period | The sum of the Outputs and Inputs total columns from the above row (This Period Outputs £-260 + This Period Inputs £20 = £240) |

| VAT/Bank postings this month | The total of any VAT Payments/Adjustments made in the period |

| NET value this period | The sum of Net Inputs/Outputs This Period and VAT/Bank Postings This Month – £-240 + £0 = £-240 |

| Balance Carried Forward | The sum of the Balance Brought Forward figure at the top of the report, and the NET Value This Period figure at the bottom of the report – £-4600.38 (Balance Brought Forward) + £-240.00 (NET Value this period) = £-4840.38 (Balance Carried Forward) |

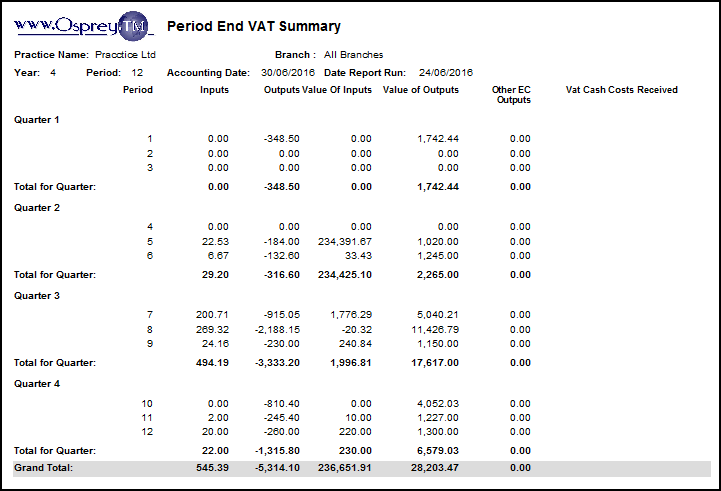

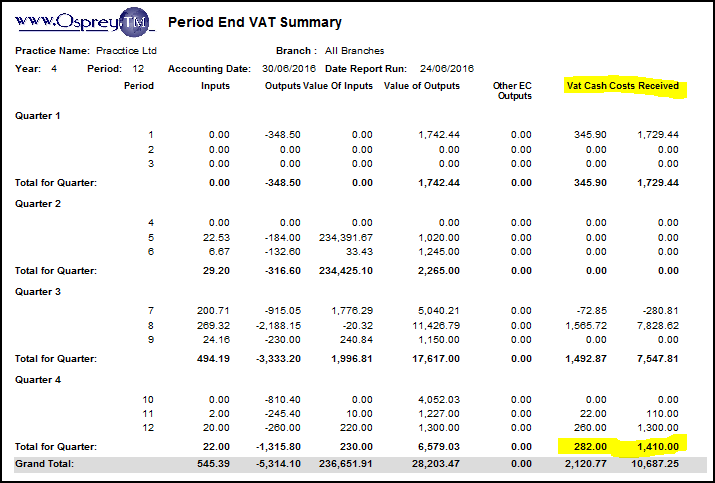

Period End VAT Summary (Reports > Financial Management > Period End)

This totals the period figures from the VAT Journal and sub totals at each VAT Quarter End.

- Inputs = total VAT on all Purchases.

- Value of Inputs = total of posting amount from purchases.

- Outputs = Sales VAT

- Value of Outputs = Sales Total of posting value

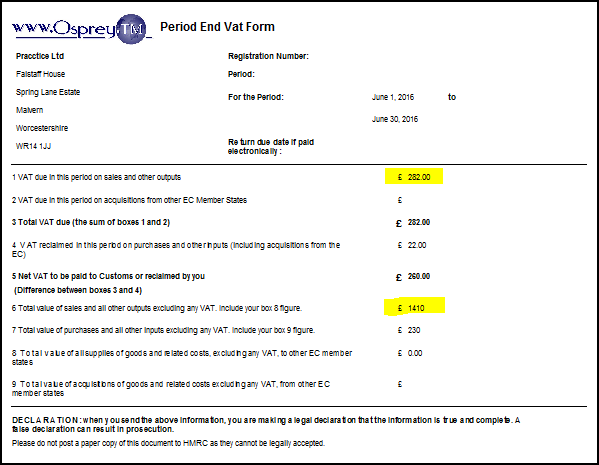

Period End VAT Form (Reports > Financial Management > Period End)

This report takes its figures from the VAT Summary report and can be used to enter the figures on your online VAT Return.

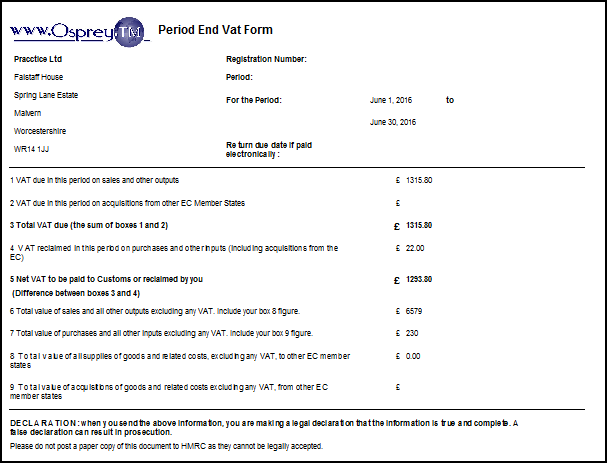

- Box 1 Shows Outputs from Quarter on VAT Summary

- Box 4 Shows Inputs from Quarter on VAT Summary

- Box 6 Shows the Value of Outputs from Quarter on VAT Summary

- Box 7 Value of Inputs from Quarter on VAT Summary

The amount of VAT to pay should show in box 5 on the above form. This should be posted to the VAT JNL in Osprey > Banks and Journals as a VAT Payment.

Cash Accounting

It is not recommended to use the Purchase Ledgers in Osprey if your business runs on the Cash Accounting style of VAT. This is because the purchase ledger invoices will become liable for VAT as soon as they are posted, and not when you pay them. If you always pay your suppliers in full as soon as the invoice is raised / posted, then you can use purchase ledgers.

The Cash Accounting style of VAT means that you do not become liable for VAT until

- Your client pays any bill you have delivered

- You pay your supplier for any invoices they have raised

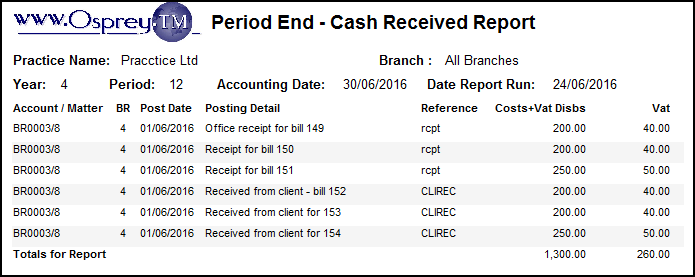

All of the reports above will be used for cash accounting, other than for your Sales VATfigures, you will need to use the Period End Cash Received report (Reports > Financial Management > Period End):

From the VAT Summary (Reports > Financial Management > Period End), check the Vat Cash and Costs Received columns:

And then compare to the VAT Form (Reports > Financial Management > Period End):