Audit Adjustments

Updated Sep 23rd, 2024

Who is this guide for?

Accounts Users and Accounts Supervisors

Your accountant or auditor may ask you to make changes to your accounts. This guide will assist you in posting these adjustments

An example of the list of adjustments is as follows:

| Debit | Credit | |

|---|---|---|

| Debtors | 150 | |

| Fees Journal | 1500 | |

| VAT | 75 | |

| Fixed Assets | 430 | |

| Loan Account | 723 | |

| Bank Current Account | 327 | |

| Wages Control | 140 | |

| PAYE and NI | 152 | |

| Drawings | 4321 | |

| Last Year’s Profit | 4418 |

Nominals

Firstly from the list extract the postings that are not nominals.

| Debtors |

| Fees Journal |

| VAT |

| Bank Current Account |

| Last Year’s Profit |

The remaining items are then posted using nominal journals.

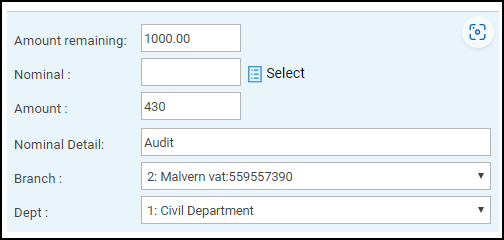

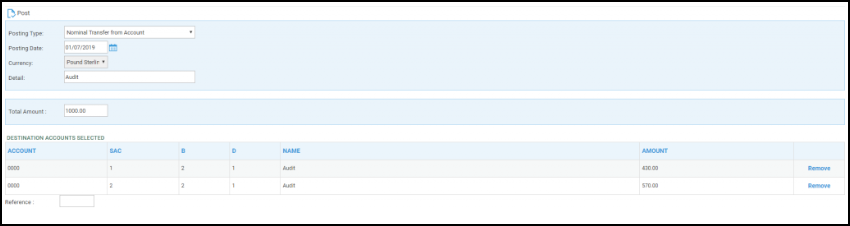

Add all the Debits remaining – i.e. 430.00 + 140.00 + 4321.00 and on the nominal suspense account

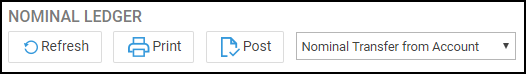

Select the posting type transfer from account.

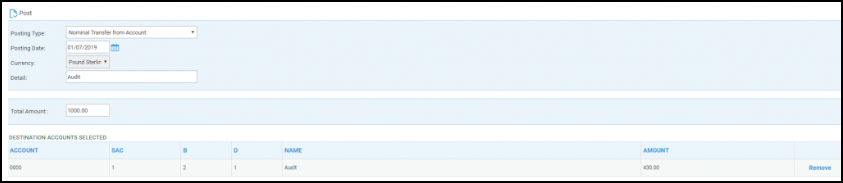

Enter the posting details and then the full amount calculated. In the nominal selection box, enter the first nominal i.e. fixed assets and under that, enter the value i.e 430.00.

Select Accept in the centre screen.

Now enter the second nominal and value. When the total has been reached, enter a reference.

Then select ‘Post’.

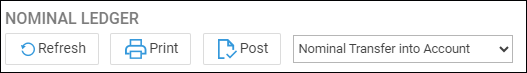

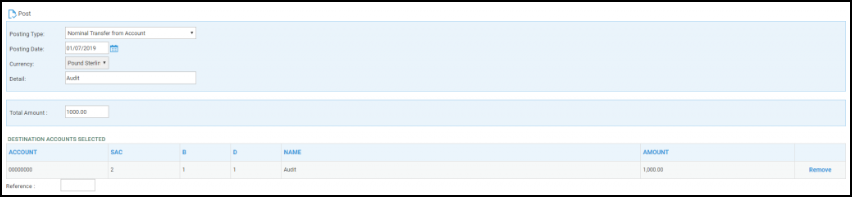

Now add all the Credits remaining – i.e. 723.00 + 152.00.

On the nominal suspense account select the posting type transfer into account.

Enter the posting details and then the full amount calculated. Continue to enter the nominal codes as required and their values.

When the total has been reached, enter a reference and then select ‘Post’.

Debtors

Adjustments to debtors have to be made on the client ledger card. The Auditor must provide the clients account number to perform the posting.

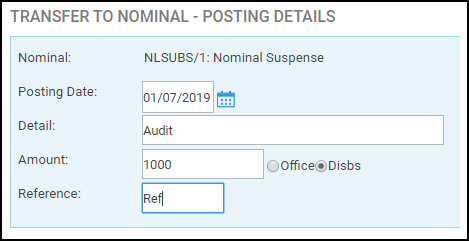

If you wish to Debit Debtors, select the required client’s ledger card and choose the posting type transfer from Nominal. Then select Post. Complete the posting screen using the nominal code for Nominal Suspense.

If you wish to Credit Debtors, select the required client’s ledger card and choose the posting type transfer to Nominal. Post. Complete the posting screen using the nominal code for Nominal Suspense.

Fees Journal

To adjust the Fees Journal a bill or a credit note must be posted. Posting a bill will increase the fees figure, or a credit note will decrease the fees figure. Bill and credit note postings will also affect the Debtors, so it will be necessary to adjust the debtors back again once the bill or credit note has been posted.

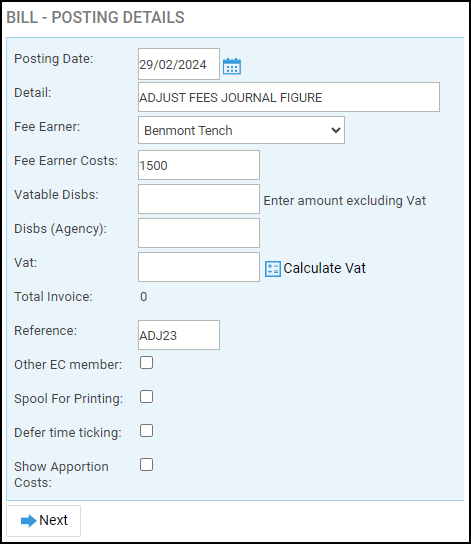

Firstly post your bill or credit note. On the Client Suspense ledger, select the posting type of Bill or Credit note and click Post. Enter the details as relevant, ensuring not to enter a figure into the VAT box, as this will otherwise affect your VAT journal account too. Click Next.

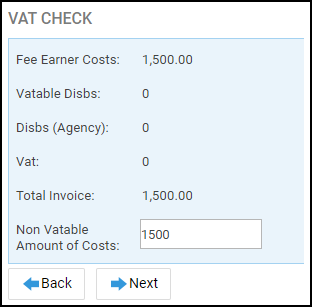

In the VAT Check box, enter the full amount of the adjustment – this means that the entire amount of the adjustment is non-vatable and will show as 0 on your VAT journal. Click Next.

Click Post on the Time Allocation screen.

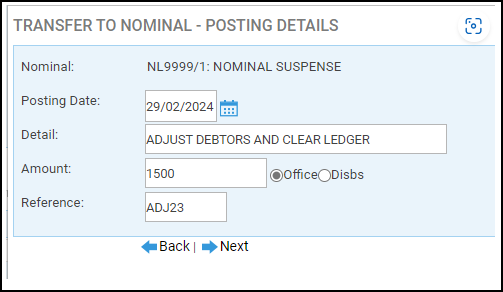

The Fees figure will now have been adjusted, but this entry will also have affected the Debtors, and we will also have a balance on our client ledger. To reduce the Debtors and clear the ledger card, post the next entry.

Select the posting type of n Transfer To Nominal if you posted a bill in step 1 or n Transfer From Nominal if you posted a credit note in step 1. Select the adjustment nominal provided to you by your accountant. Enter the amount of the adjustment along with the relevant description and reference, and click Next.

Allocate the transfer against the bill you posted in step 1 and click Post.

The suspense ledger will now have returned to 0 and your Debtors figure will have been reduced.

VAT

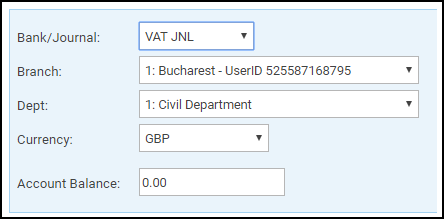

Debit VAT – Debit VAT is similar to a payment to H M Customs, and is posted using Banks and Journals from the left menu. From the journal selection at the top of the screen, select the drop down list and then VAT Journal.

Select the branch and department (not ALL) and then refresh. A post button will appear. After selecting Post, the posting screen will show.

Leave the top selection as payment and complete the posting. Note this posting goes to your normal office bank.

After completing the posting, select Nominal ledgers and then the nominal suspense. Select the posting type Receipt and then Post. Complete the posting screen with the same details as the VAT Journal posting, making sure to use the same bank.

Finally in banks and journals select the office bank and refresh and reconcile both postings against each other.

Credit VAT – Credit VAT is similar to a refund from H M Customs, and is posted using Banks and Journals from the left menu. From the journal selection at the top of the screen, select the drop down list and then VAT Journal. Select the branch and department (not All) and then refresh. A post button will appear. After selecting Post, the posting screen will show. Change the top selection to VAT Adjustment and complete the posting. Note this posting goes to your normal office bank.

After completing the posting, select Nominal ledgers and then the nominal suspense. Select the posting type Payment and then Post. Complete the posting screen with the same details as the VAT Journal posting, making sure to use the same bank.

Finally in banks and journals select the office bank and refresh and reconcile both postings against each other.

Bank Office Current Account

A specific adjustment to the bank would be done in the same place where it was originally posted.

A general adjustment to the bank can be posted by selecting the Nominal Ledgers and then the Nominal Suspense account.

To Debit the Bank account, select Receipt posting on the Nominal Ledger Suspense.

To Credit the Bank account, select Payment posting on the Nominal Ledger Suspense.

On each of these postings make sure the bank in the centre of the posting screen is the same as the bank you wish to adjust.

Last Year’s Profit

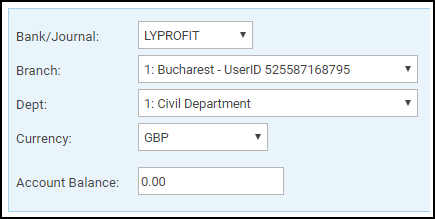

Adjustments to Last Year’s Profit are made from Banks and Journals.

At the top of the screen use the drop down arrow against the bank name.

Select LYProfit from the list.

Select a branch and department (do NOT select ALL) and then refresh and select Post.

On the posting screen the top line is changed to the correct posting required.

Transfer LYP to nominal – will Debit LYProfit.

Transfer Nominal to LYP – will Credit LYProfit.

The nominal code to enter on the posting screen will be the nominal suspense.