Fees Analysis – which is right for me?

Updated Jun 19th, 2024

Who is this guide for?

Accounts Supervisors, Case Management Supervisors, System Supervisors and Managements

There are three different ways to analyse your fees in Osprey. The different options are detailed below.

Fees Analysis

Using the standard Fees Analysis report, all fees billed will be attributed to the Matter Fee Earner, this is the fee earner set up in the matter details, unless the fee earner has been changed in the bill posting screen.

Regardless of any time recorded and ticked against the bill, or manual costs apportionment during the bill posting, all fees will be attributed to the ledger fee earner.

e.g. Bill posted for £500 costs on matter ABC0123/1, which is owned by fee earner B. Fee earner A posted £25.00, B posted £75.00 and C posted £400 of time which was ticked against the bill. The Fees Analysis report will show the full £500 on this matter against fee earner B, because he is the matter owner.

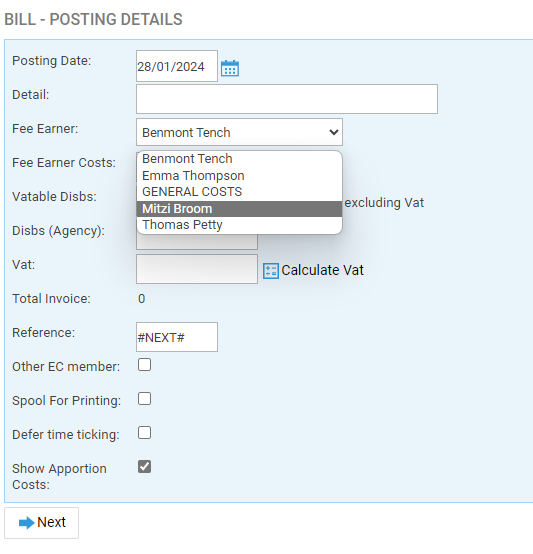

e.g. 2. Bill posted for £250 costs on matter ABC0123/1 which is owned by fee earner B. When the bill was posted, fee earner C was selected in the posting screen, meaning that the fees analysis will report this bill as being attributed to fee earner C.

Fees Analysis by Time Fee Earner

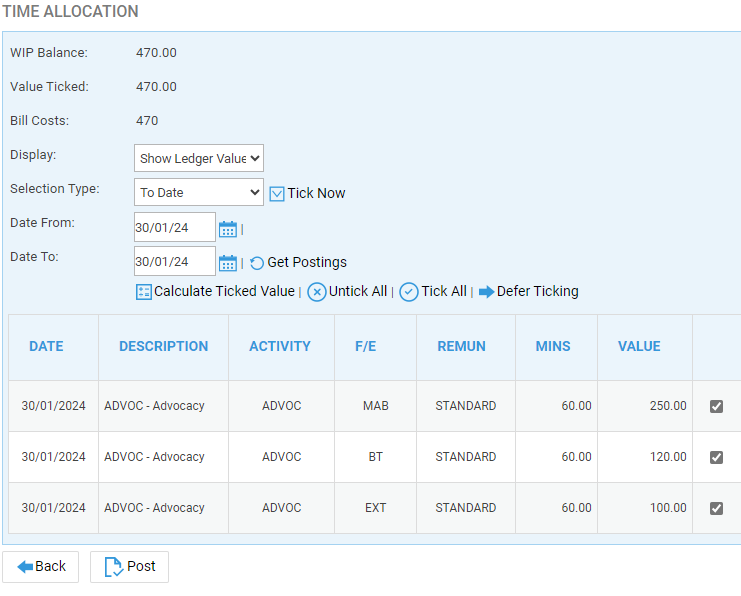

If your fee earners time record, and this time is ticked off against your bills, the Fees Analysis by Time Fee Earner will split the bill costs to each fee earner at the same percentage of the total time that they posted.

Where the bill costs match the time ticked exactly each fee earner will get the amount of time they posted in fees on the Fees Analysis by Time Fee Earner report. If no time is ticked the fees default back to the matter owner / ledger fee earner.

If the costs entered on the bill are more than the total time ticked then:

e.g. Bill posted for £500 costs on matter ABC0123/1, which is owned by fee earner B. Fee earner A posted £20.00, B posted £70.00 and C posted £400 of time which was ticked against the bill (total time ticked = £490, £10 less than the bill costs). The Fees Analysis report will show each of these fee earners time amounts/total time ticked * Bill Costs meaning that

- fee earner A gets £71.43

- fee earner B gets £20.41

- fee earner C gets £408.16

If the costs entered on the bill are less than the total time ticked then:

e.g. Bill posted for £450 costs on matter ABC0123/1, which is owned by fee earner B. Fee earner A posted £20.00, B posted £70.00 and C posted £400 of time which was ticked against the bill (total time ticked = £490, £40 more than the bill costs). The Fees Analysis report will show each of these fee earners time amounts/total time ticked * Bill Costs meaning that

- fee earner A gets £64.28

- fee earner B gets £18.37

- fee earner C gets £367.35

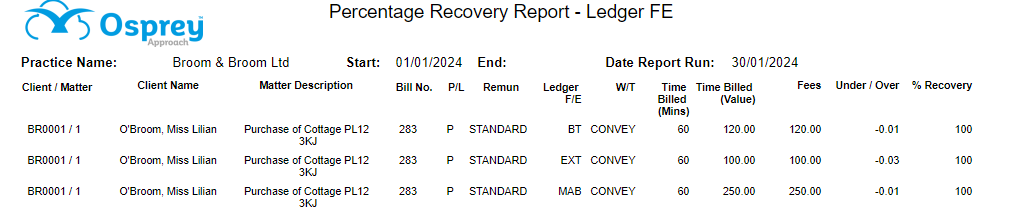

You can use the Percentage Recovery report to show the split between fee earners, and what percentage of your costs were recovered. In the example below we can see that bill number 283 had 3 fee earners’ time ticked against it, so has split the bill proportionately.

Fees Analysis by Apportioned Costs

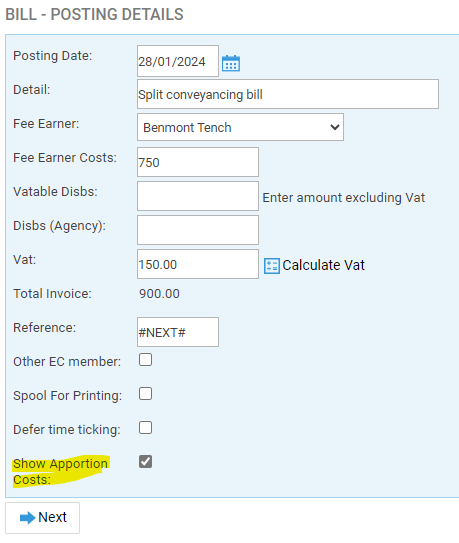

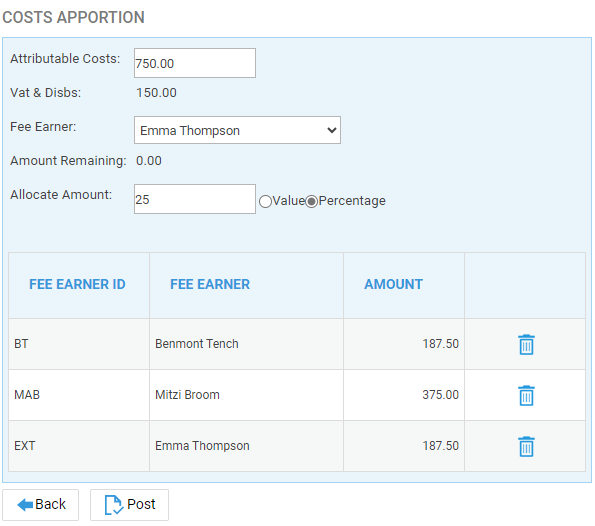

This method of splitting costs between fee earners is useful if your fee earners do not time record, but do work on the same cases, such as for in a conveyancing matter. When the bill is posted, you can tick the Show Costs Apportionment box

and split the costs between fee earners at a percentage, or by monetary value.

The Fees Analysis by Apportioned Costs report shows these manually entered splits, or if no apportionment has been carried out on a bill the full costs will be attributed back to the matter fee earner/owner.